Plus500 Tutorial: How to open and close a trade in Plus500

Plus500 Tutorial: How to open and close a trade in Plus500

I’ll explain how to open and close a trade in Plus500. A trader with a Plus500 account can trade CFDs on Forex, Stocks, Commodities , Options and Indices.

Below I will explain to you how to do this and what the options mean that you see during opening a position.

Contents

- Finding an instrument that you want to invest in

- Difference between short and buy

- Stock information screen explained

- Short and buy screen explained

Finding an instrument that you want to invest in

- Login to your Plus500 account via the webtrader. Create an new account if you haven’t done it yet.

- Click on ‘Real Money’.

- Login and in the menu at the left side of the page, click on ‘Trade’. Here a list of all tradeable instruments can be seen. Now Plus500 is one of the few online CFD brokers who has that many instruments, so you can trade stocks, commodities, indices and forex from all across the world.

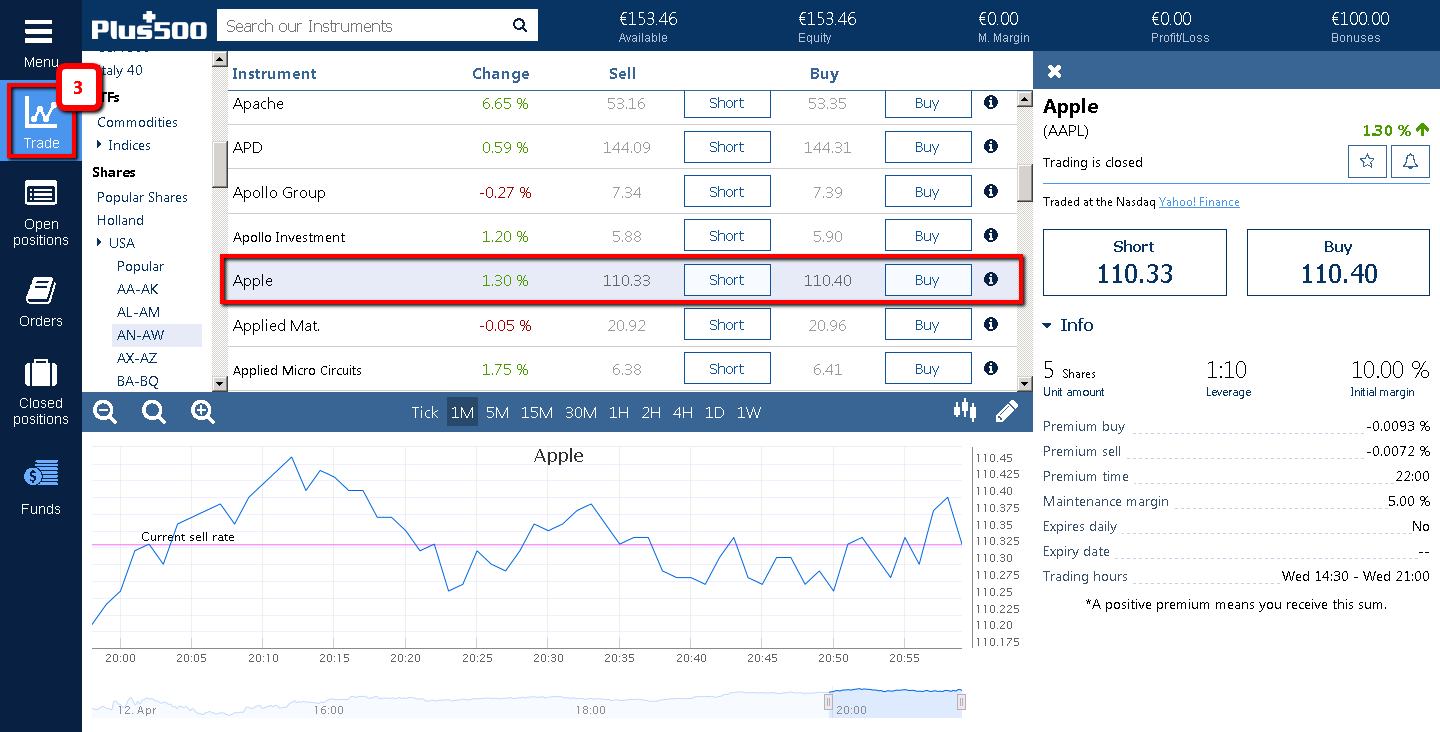

- Now for the sake of learning, let’s say you want to trade in the USA stocks of Apple (iPhone, iPads anyone?). You now go to: Trade -> Shares -> USA -> AN-AW and find Apple in the list. You could also just search for ‘Apple’ in the search field at the top left corner, next to the Plus 500 logo.

-

When you click on the Apple row, information about that specific stock is displayed on the right. In the next section I will explain to you what this all means.

- For now, important to know is what the difference between short and buy is.

Difference between short and buy

In the screenshot above you must have noticed two options: short and buy. For the people who know a bit more about trading, simply put this is the same as going bear and bull. Whereas short is the same as going bear and buy is the same as going bull.

For the people who don’t know what I’m talking about:

Going short means you anticipate that the stock will go down. Let’s say you short a stock at £20 and tomorrow the stock value becomes £15. You will have made a profit of £5.

Buying a stock means you anticipate the exact opposite. You think the stock is going well, so the stock will increase. Let’s say you buy a stock at £20 and tomorrow the stock value becomes £25. Your profit is £5.

Of course these are just examples, if you are using Plus500 you’ll also get leverage and your profit (or loss) will most likely be a lot more.

Stock information screen explained

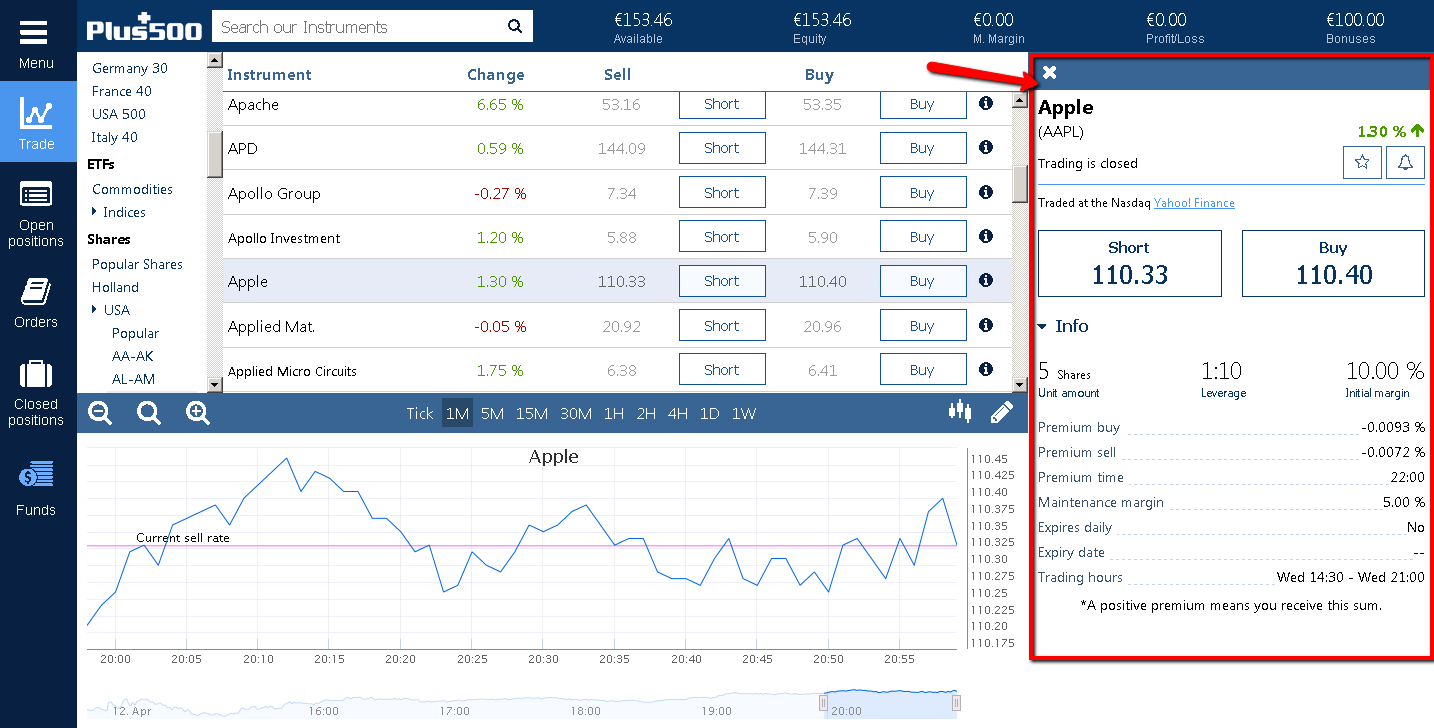

When you click on an instrument in Plus500 you will be displayed a screen with information about that instrument. Let’s take Apple for example again. Look at the screenshot below. I clicked on Apple and information about that stock is displayed on the right now. Plus500 gives a couple of important information here, which I will explain in detail below.

The first thing you see is the title: Apple (AAPL) this is the stock you selected. Between the brackets the stock symbol is shown. This is the stock acronym that is used worldwide to identify that stock. Sometimes a stock name can be a lot a like, looking for that stock with the unique symbol makes it a lot easier to find that stock.

Next you’ll see pricing information of this stock. The current high and low values are shown here. This is taken right out of the Yahoo! Finance page. You can also see how much the price has changed in percentage in comparison with the opening value of that day. When the stock market is closed, you’ll see the line ‘Trading is closed’.

The line ‘Traded at the Nasdaq Yahoo! Finance’ just tells you where the stock belongs and where you can find it on Yahoo! Finance. Nasdaq the second-largest American stock exchange, usually consists of a lot of technical companies.

Next there are two buttons available. Short and buy and below this the value of the stock that you will short or buy. You see a little difference here. This is called the spread, the spread is what you pay to the broker as a commission. This usually is not a lot, depending on the stock’s popularity and value. Be careful with this, because to profit you need to make more money than you pay in the spread. When opening a stock I suggest you to try it in demo mode, to see how much the spread is exactly.

In the last section there is some more information available. If you don’t see it, click on ‘Info’ to uncollapse this information. I will explain to you the most important information:

Leverage: this is not the same everywhere. Sometimes it is 1:10, but the maximum leverage is 1:30. Leverage is a way to make your money worth more than it is. Let’s say you want to use £100. A leverage of 1:10 means your £100 is worth £100 * 10 = £1000. This means with only £100, you can buy stocks that is worth a £1000. Yes, this means you can make 10 times more profit, but this also means you could lose 10 times faster. This last thing sounds scary, but Plus500 gives us a negative balance protection, which is an EU requirement for all brokers. This means you cannot lose more than your account balance.

A more detailed explanation about CFD stocks and leverage can be found here.

Overnight: If you keep a position open overnight, a night overnight fee is added or substracted from your position. This means you pay a small amount of money overnight (or you gain it). This is very low usually, so I don’t pay much attention to it. As you can see Apple’s overnight buy fee is -0.0093% of your position.

Overnight time: This is the time that the overnight fee is done. I almost always keep my position open for a night and I have never really noticed this fee much.

Maintenance margin: This is important information, because if your position goes below this margin your position will be automatically closed. So to keep your positon open, your current account balance needs to exceed this margin. Thankfully, this isn’t much either. I usually deposit £100 and use that £100 completely in a position and this position can be kept overnight without it autoclosing on me. If you open a position, this margin will also be automatically calculated for you in the top header (look for M. Margin) – so you don’t even have to calculate this yourself.

Currency Conversion Fee – Plus500 will charge a Currency Conversion Fee for all trades on instruments denominated in a currency different from the currency of your account.

The Currency Conversion Fee will be up to 0.5% of the trade’s realized net profit and loss and reflected in real-time into the unrealized net profit and loss of an open position.

Inactivity Fee – A fee of up to USD 10 per month will be levied, should you not log in to your trading account for a period of at least three months. This fee will be charged once a month from that moment onwards, as long as no login is made to the account. The inactivity fee will be equal to the lesser of the remaining available balance in your account or USD 10 (or equivalent depending on your currency). In order to avoid this fee, simply log into your trading account from time to time, as this is deemed sufficient activity to prevent a fee from being charged.

Expires daily/expiry date: I have never noticed this much. I don’t think this applies to stock, but might apply to something else. Just make sure to check if this is ‘No’.

Trading hours: This is important to know. Plus500 automatically changes this time to your timezone. An American stock is usually open from 9.30 am to 4 pm American time, but the time shown here is in your own time. Which is great and makes it so much easier to time your trades well.

Now you understand the information screen. The next screen to explain is the screen when you want to open a position.

Short and buy screen explained

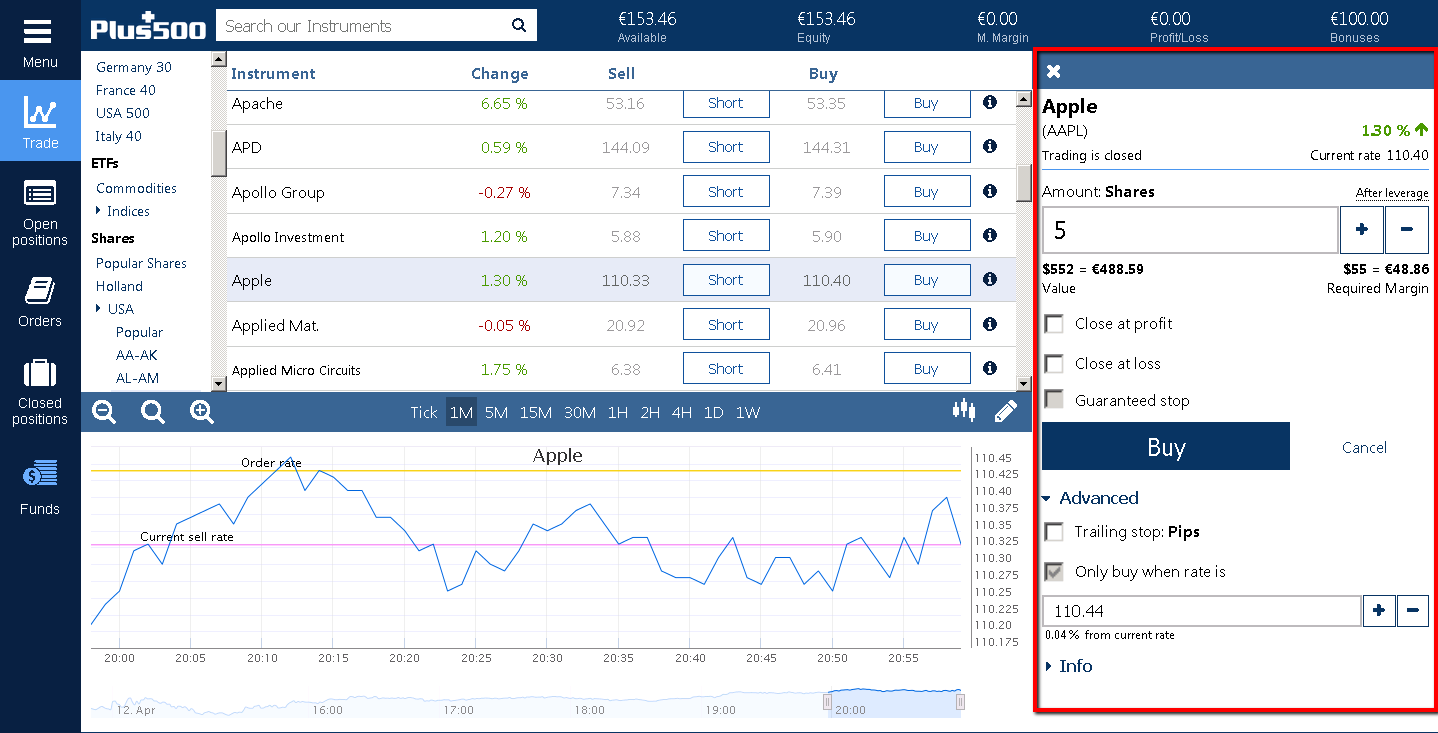

Now let’s say you want to buy Apple. Click on the Buy button. This is what you will see now:

The short screen has the same information, so I will explain this only once.

The Plus500 short and buy screen is very nicely done with the user in mind. It gives great information and makes it easy to open a trade. The first thing you see is the stock name and symbol. The current value and the percentage of movement since the opening time.

Now to open a position you need to decide how many shares you want to buy. Let’s say here youw ant to buy 5 shares. The value of this 522 dollar, which is the same as 488,59 euro. Plus500 automatically takes the foreign exchange price of your currency and the one the stock is using, which usually are dollars. This is great, you don’t really have to pay much attention to this. Also, because Plus500 is giving you leverage of 1:10 of this stock, you only need 55 dollar to buy 5 shares that is valued 522 dollar. Amazing right?

So really you only need to pay attention to the ‘Required Margin’. This is the amount that will be substracted from your account to use in the position. So not the value, but the required margin. This is important.

Next you have ‘Close at profit’ and ‘Close at loss’. These options give you the ability to let Plus500 automatically close your position when the stock value reaches a certain value that you set. This is great if you don’t have the time to close it yourself and want to let it happen. Also, if you are losing this guarantees a certain loss. So instead of losing your whole position, you only lose what you want. Or the opposite: profit what you want.

Guaranteed stop sets an absolute limit on your potential loss. The position will be closed at the value you specified, even if the market gaps suddenly, your position will be closed at the value you specified.

The advanced section I will explain in a later article.

Below this section, the information I explained earlier is displayed again for your convenience.

When you are ready, just click on the big blue button ‘Buy’ and your position will be opened. This position will be shown in the left menu at ‘Open positions’. Or in the stock list, under the stock itself.

Don’t forget, to truly learn how to trade, you need to try it yourself for a couple of times to be able to get the hang of it. Try it out with small amounts of real money first to feel how you react to profits or losses. This is important to know of yourself prior to trading.

*How to buy and sell bitcoin on Plus500*

*How to buy and sell Ethereum on PLus500*

Go back to: