What is sentimental analysis in the stock market?

This is a process of net short and net long traders position identification for the purpose of influencing your own trading decisions in the currency market.

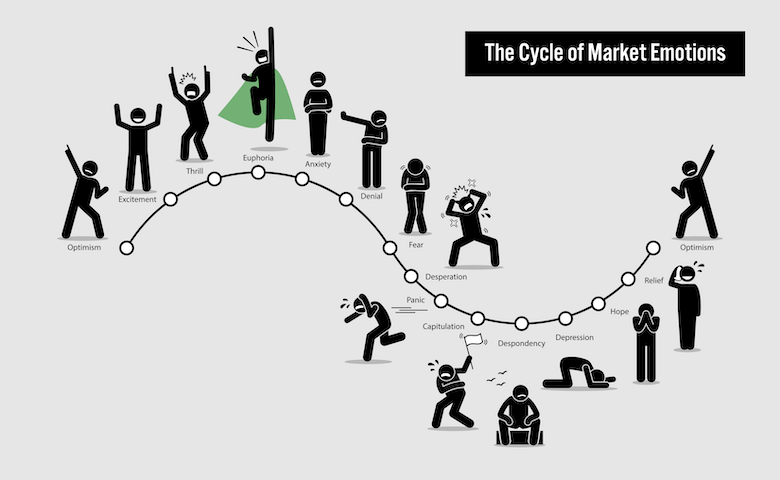

Sentimental analysis is not only used in forex but also in stocks as well as other assets. This process is a useful tool to traders as it helps them to understand and take action on price behavior. While waiting to take a position in the opposite direction of sentiment, contrarian investors will look for crowds to either buy or sell a specific pair of currency.

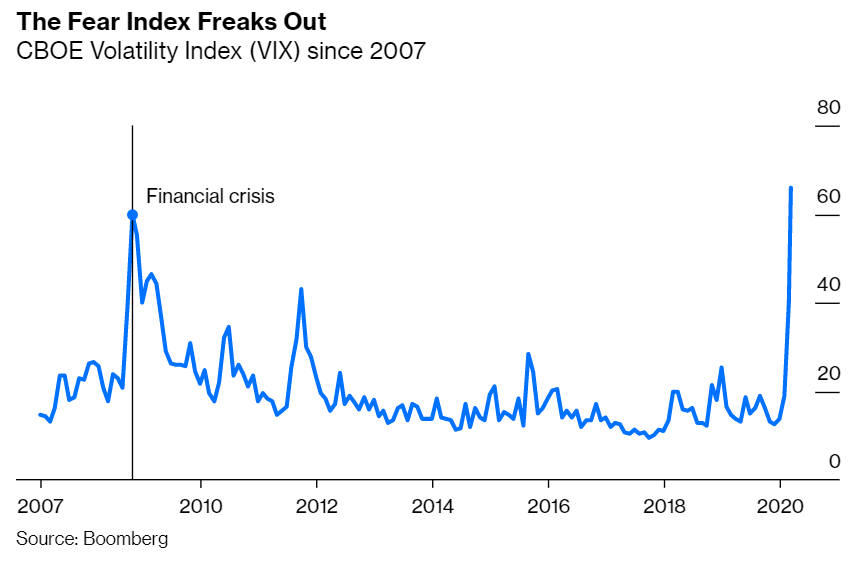

An example of negative sentiment is in 2016 when a large single movement in GBP/USD took place. Following Britain’s vote to leave European Union, GBP slumped to a 31-year low. The following year there was a broadly positive sentiment before negative sentiment took over again in 2018. Not until 2019 did the prices start to trend higher. For a chart, a rising sentiment indicates that to keep pushing the trend up, few traders are left.

Components of Sentimental Analysis

Basic sentiment analysis involves the determination process of whether a piece of writing is neutral, negative, or positive. Data analysts within large enterprises use sentiment analysis to conduct thorough market research, gauge public opinion, monitor product, and brand reputation, and understand customer experiences.

The analysis uses machine learning in combination with natural language processing. In Artificial Intelligence with important business applications, it is a great technique. However, stock sentiment analysis on its own cannot always predict price changes. To determine new scenarios, it can be combined with technical analysis for better results.