How can you make money in trading with using the moving averages indicator? Before we answer you that question let us first explain what a SMA and an EMA is.

SMA stands for simple moving average and EMA stands for exponential moving average. The difference between an EMA and SMA is that the recent price change has more effect on EMA then SMA. The reason for that is that the calculation formula of EMA is has more weight on recent price changes then a SMA calculation formula. That’s why we at 101trading.co.uk prefer to use EMA.

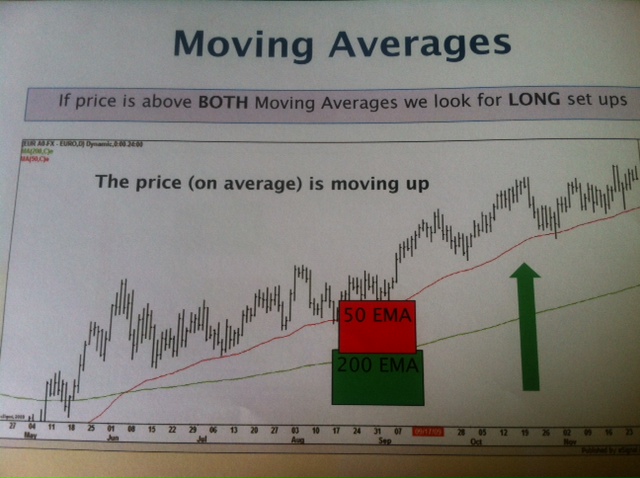

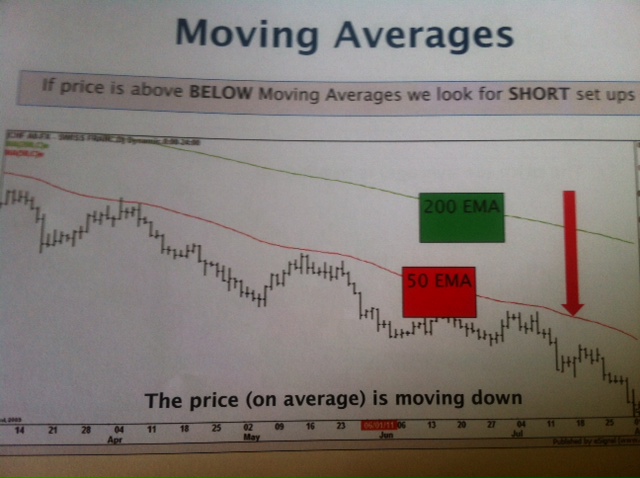

The two main uses EMA’s for identify a trend are the 50 EMA (average of the last 50 bars) and the 200 EMA (average of the last 200 bars).

The 50 EMA is being used often to determine a trend on medium trend and the 200 EMA is often being used to determine a trend on the long term.

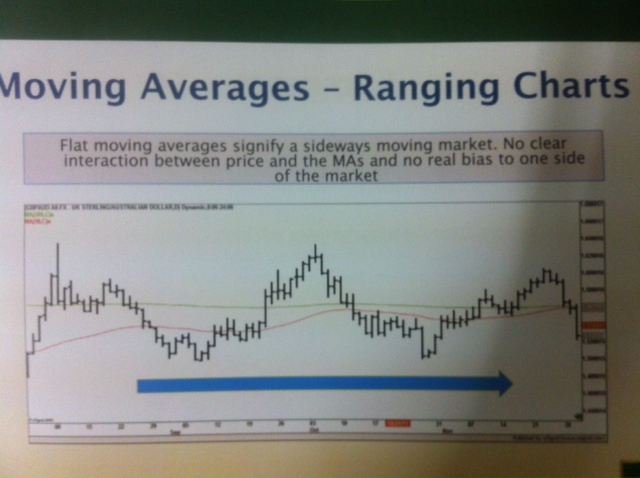

The benefit of using multiple EMA’s is that it gives you a more accurate picture of the trend. Most common EMA’s used are the 20 EMA, 50 EMA, 100 EMA and the 200 EMA. The bigger the separation between these EMA’s become, the stronger the trend becomes.