PayPal IPO gives new investment opportunity

Today is the PayPal IPO. After thirteen years being with Ebay, Paypal is now a separate company on the stock exchange. And that is good news for us investors and traders. If you are interested in investing in Paypal then you must read this article. In this article you will get to know what the business model is from Paypal and what the potential earnings can be.

Paypal IPO : why?

Why did Ebay and Paypal seperated from each other? The reason why they have separated is because the mobile payment market is showing big promises as the e-commerce market keeps becoming bigger and bigger. And more and more big tech companies like Apple , Amazone and Google have created their own mobile payment system in order to benefit from the growth of mobile- and on-line payment market. If Paypal stay with Ebay they will be limited in teaming up with other e-commerce websites. (as they see Ebay as their rival) With Ebay gone now it will be interesting to see on how the new income stream of Paypal will look like. With the extra cash that PayPal IPO gives it will be interesting to see of what kind of companies PayPal will acquire.

PayPal Business Model

Lets take a look on how PayPal earns their money. PayPal generates revenues from fees charged to consumers and merchants for different payment-related services. PayPal allows consumers to transfer funds to merchants in a secure manner through the PayPal digital wallet. The cool thing about the Paypal Digital Wallet is that it not includes internal resources such as the PayPal account balance and PayPal credit account but they also include external resources such as bank transfers or credit and debit cards. And one other thing PayPal does not charge consumers for funding or withdrawing funds but they only charge fees when consumers are lending money by the PayPal Credit.

Most of PayPal’s revenues are generated from transaction fees that is charged to merchants. The fee percentage vary from 2.2% + $0.3 per transaction for eligible merchants to 3.9% + a fixed fee based on currency received for international fees. With a other service PayPal Here Paypal charges a transaction fee of 3.5% of the transaction value and offers a free point-of-sale station for small businesses to process credit/debit cards in their stores.

Start trading in PayPal now. Open an trading account and receiving a nice welcome bonus of £20,-

PayPal Growth

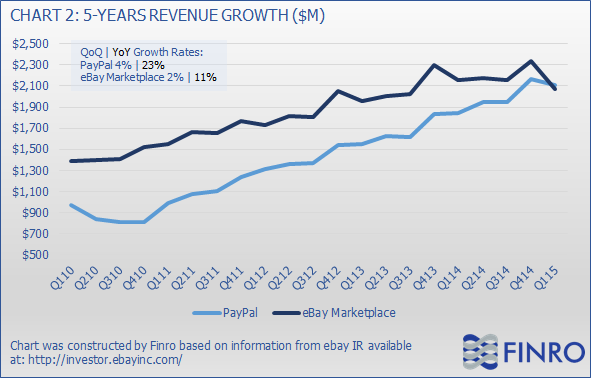

As you can see in the graph above PayPal has been growing very strongly. In the first quarter of 2010, PayPal processed $21.34 billion in payments. By the fourth quarter of 2012, this amount grew to $41.47 billion. In the first quarter of 2015, the amount of payments processed grew to $61.41 billion. This represents nearly 300% growth in payments processed since 2010. This number is likely to grow in the future as PayPal expands its mobile payments business. PayPal processes approximately 30% of its payments on mobile devices, up from merely 1% in 2010. With these good numbers it makes it very interesting for investors to invest in the PayPal IPO.

Conclusions

The long-awaited PayPal IPO is expected has finally taken place. With the PayPal’s impressive TPV and net revenue growth rates on top of the promising expansion potential it makes the PayPal stock a very attractive growth investment. Without the restrictions of Ebay Paypal can focus on offering their services to the competition of Ebay as well. So there is a very good chance that Paypal can grow more in value over time. The first few weeks could be very volatile , so short term traders can benefit nicely from it.