Online Trading: How to make a good profit with just 160 Euro

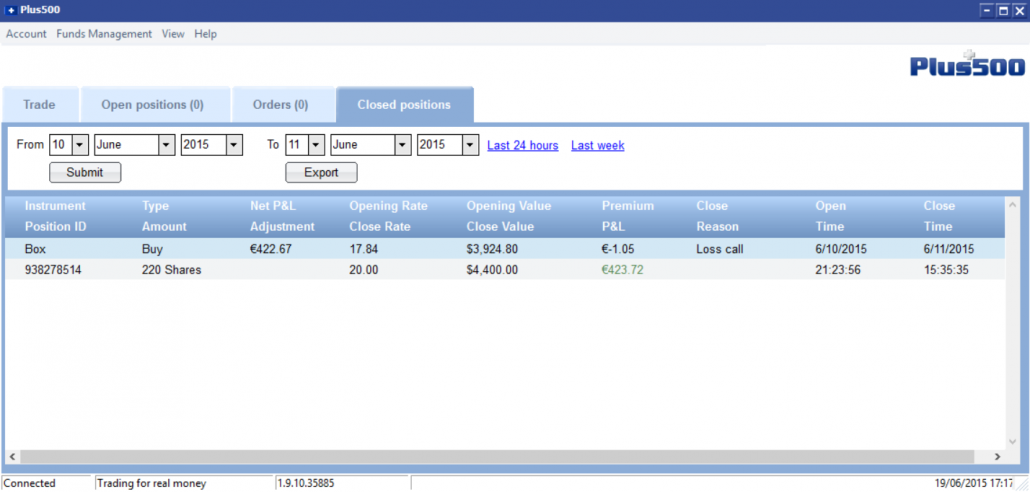

Starting with online trading is much easier than you think. In this article we will explain to you how we trade and how we made a profit of 422 euro with only a small deposit of 160 euro.

Why online trading?

Trading used to be only for banks and big companies. Now, with the internet, it is possible for anyone with an internet connection to trade. This means you can not only trade from home, but from wherever you are and whenever you want. Besides this awesome fact, you can also trade with leverage. Leverage? Yes, with a leverage of 1:20 you can trade in stocks (CFD’s) 20 times more worth than your deposit. The advantage of this is that you can receive a very high profit with a small deposit.

For example:

Let’s say you have 100 pound and the leverage is 1:20, with only 100 pound you can open a position worth of 2.000 pound (100 * 20).

You can see with only a small deposit, you can make a big profit. This is perfect, because even if you don’t have a lot of money, you can make good money with online trading.

So how can you start online trading?

First of all, sign up to an online broker. Compare the best online brokers here and receive a 20 pound bonus to practice with. There are no obligations when you sign up, so go ahead and try it out. Find out how to receive more bonus here.

In our previous blog “Smart online trading in stock CTRIP: 1019 profit”, we have explained one of our trading strategies:

- Find a reason to trade

- Open and close a position

- Evaluate your trade

Now how can you start doing exactly this? What sources do you use? This article explains just that. We will also use a real example of one of our own trades. Now you can follow these quick steps to begin to trade right away. The steps below follow the strategy that we learned before, but this time we put it in action! You can even use these steps below as a checklist for your own trading.

Step 1. Choosing the stock

First of all find a good earnings announcement calendar like the one from Yahoo:

- Review which stocks have an earnings report coming out today.

- Pay attention and only choose the ones that are available in your online broker stocklist.

- Only choose stocks that have a time supplied. Write this down.

- Find out what the leverage is, the higher, the better.

- Find out about the company.

A real example:

On the 10th of June, 2015 we looked at the earnings calendar and we found Box Inc (NYSE: BOX). First thing we did was:

- Find out if this stock was on Plus500, it is. Now let’s check the leverage: 1:20. Great!

- The time of release is after market close. Love it! We tend to like these stocks more, because during after- and pre-market, you usually can predict what direction the stock is going. So at market open, we would be more prepared.

- Now a little Google search helped us learn about this company, it is a technology company much like Dropbox. They use the cloud to give people the chance to back up or share their files online, so it can be accessed anywhere. This sounds good! Let’s move on.

Step 2. Should I open a long or short position?

After learning about the company, follow this checklist:

- Find out whether the announcement will be good or bad. It doesn’t matter which direction it goes, because either way, you can profit. You should already know that the movement of a stock is almost always volatile whenever an earnings announcement gets released. To be sure, you could check the volume of the stock on Yahoo Finance, for example here.

- StockTwits: one way to find out whether the earnings announcement will be good or bad is by reading what other people say about this stock. We tend to read StockTwits for this. For BOX the link is: You can insert your own stock in the search field and then view what other people think about this stock. You can even see whether or not they think it is going up (bullish) or down (bearish). If you see a lot of bullish, it most likely will be bullish.

As for BOX, we could see it go up, not only because of what we read online, but also looking at the past quarterly earnings numbers. Where do we find these numbers? At the website of the company itself. All companies where you can invest in has an investors page. BOX’s investors page can be found at: All this together has decided it for us. We think BOX will go up. Next we did the following: Now we wait. News is out! The market is still closed though. All we can do is check the stock price (the aftermarket/premarket one) constantly, you can use the NASDAQ after hours website for this. Yahoo Finance also provides this information. It is in the small font just under the open market price. So what now? Be sure to be ready when the news comes out, the stock will now go up or down very fast. Our stock BOX moved up, we could already see the numbers in the aftermarket. The next day just before market open, check the numbers again. You will see at what price the stock will open. At this point we already knew that we had a win. The next thing to do is preparing ourselves to close the position as soon as possible. At market open, at the first possible opportunity we closed the position, grabbing our profit of 422 euro. Amazing! Remember this: don’t ever be greedy. Unless you know how to use a stop loss, you can wait before closing the position. More about stop loss strategies will come later. Don’t let your money sit on your account. Withdraw it, use it, enjoy it! Online Trading isn’t all work, it should be fun too. Now don’t forget to evaluate your online trading today, you can always learn from it for future trades. Got questions? Feel free to ask them below.Step 3. Open the position at the right timing

Step 4. Closing the position

Step 5. Withdraw your money unless you want to use it for a future trade again