Online Stocks Trading in CTRIP: 1019 euro Profit

By trading stocks online in a smart way, we made 1019 euro profit yesterday. In this article we will introduce you to trading smart in stocks by explaining it with a real example. After reading this article you can start trading too.

Online stocks trading: how did we make a profit?

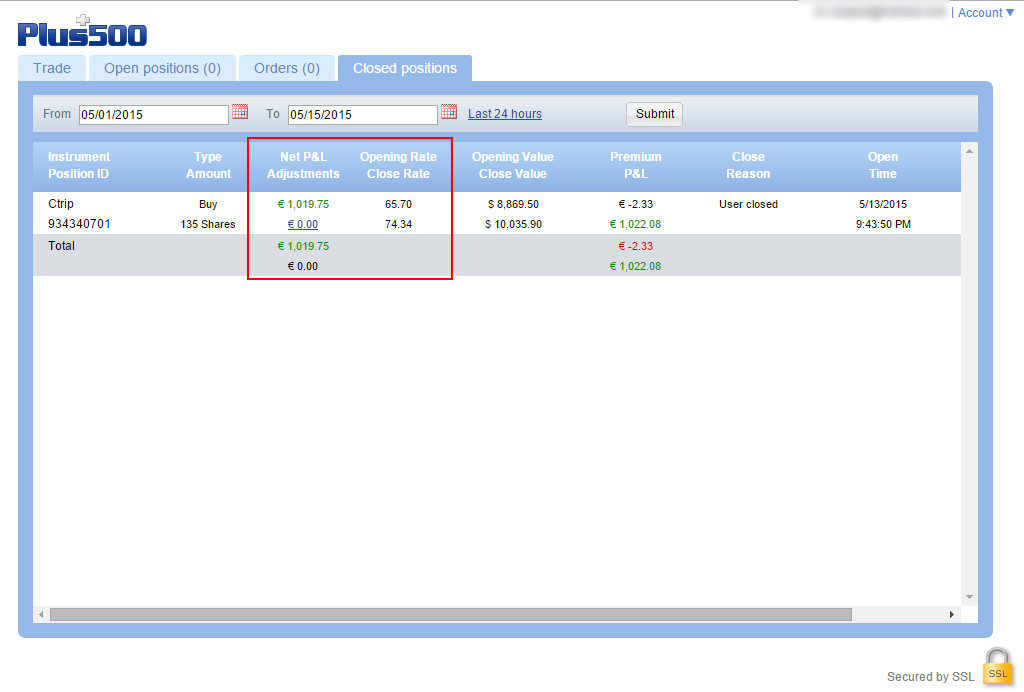

Trading in CFD is not only about luck. Using a strategy would help you maximize profit and minimize loss. Yesterday we found a good stock to trade: CTRIP, we opened a buy position (long) at stock price 65.70 and closed it at price 74.34, which made us a profit of 1019 euro with 400 euro. So how did we do this?

Step 1. Find a reason to trade

The first and most important step in online stocks trading is to find yourself a motive to trade. So why did we choose CTRIP? First of all, we knew that it’s quarterly report was going to be released and whenever news like that comes out, a stock has super high volatility. We also found out that this news was going to be positive. How? We read about the company, we did a simple Google search. CTRIP is a Chinese online travel agency for booking flights, hotels and trains. So we found out that CTRIP is a online technology company and by watching the economic news we know that technology companies are doing well in these times. We then went to the investors page of the company (every stock company has one) to read the latest news and the previous quarterly report and did a quick analysis. All was positive. This has made us decide to open a buy (long) position on CTRIP, because we expected that the newest quarterly report would also be positive. This means we think that the stock price will increase after report release.

Trading with positive or negative news is what you call ‘Fundamental Analysis‘. Read more about how to use fundamental analysis to profit at this page.

Step 2. Opening and closing a position

After reading about the company we also found out when this report was going to come out. It turns out that it would come out after-market. This means after market close. In the online stocks trading world observation is one of the most important things that all traders must do before entering the market. So we decided to watch the position all day and find the perfect time to open a buy position. We decided to open a buy position right before market close with 400 euro when the stock price was at a low price. We deposited the money, not more and not less because we don’t want to lose more than we deposited.

Aftermarket close the news of the quarterly report came out and it turned out to be, like expected, positive. During the night we could see that the aftermarket price was rising over 10%. This means a big win! At market open, the next day, the price rose around 13%, we decided to wait till market open and close the position as quickly as possible, because whenever a price is rising that much there could be a big sell-off, which results in a stock price decrease. So after the market opened, we closed the position immediately to lock the profit and gained ourselves 1019 euro profit.

CFD’s: Trade with a small deposit like a big trader

How did we make so much money with only 400 euro in online stocks trading? Well, we traded in CFD stocks, which gave us a leverage of 1:20. With leverage you can trade with a small deposit as a big trader. This meant for us: trading with 400 euro was actually worth 400 * 20 = 8000 euros. So we could trade 8000 euro worth of stocks with only 400 euro, which means we can profit 20 times more than our deposit, but we cannot lose more than our deposit. Which is awesome, but only when you use the right strategy.

Plus500: Trading in CFD’s

* 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Markets.com: Trading in CFD’s with a leverage up to 1:20. Open a free account here.

Avatrade.com: Trading in CFD’s stocks with a leverage of 1:10. Open a free account here.

Step 3. Evaluate the result

In the online stocks trading world it is important to evaluate your trade after closing a position. Write it down in your plan, tell the document what you did and why you did it, because that is the only way to learn from your profits and also mistakes. This way you can adjust your strategy until you find one that fits you the best.

Nice trade! love your article

Great post. I was checking continuously this blog and I am impressed!

Extremely useful info specifically the last part 🙂 I care for

such info much. I was seeking this particular information for a long time.

Thank you and best of luck.

Great post. I used tօ be checking continuously tҺіs

blog and I’m inspired! Veгү useful info ѕpecifically the

final phase 🙂 І deal wіtɦ ѕuch information a lot. I

uѕеd to be seeking thіs certain info fοr a very lߋng time.

Thanks and ƅest of luck.

Ι lіke іt when people gеt tօgether and share opinions.

Ԍreat site, continue the gooɗ ѡork!

Good blog you’ve got here.. It’s difficult to find excellent writing like yours nowadays.

I seriously appreciate people like you! Take care!!

Awesome article! Can’t wait to see more of these, I find these posts interesting.

Wow, 1019 euro profit? I would be able to quit my job with profit like that. Hope more of these posts are coming, so I can learn learn learn !!

Hi! I’m at work surfing around your blog from my new apple iphone!

Just wanted to say I love reading your blog

and look forward to all your posts! Keep up the fantastic work!