Trading is better! Why saving money in a bank is not always a great idea

Are you saving up money in a bank account? Most people do, because they learn to do it that way from their parents. This isn’t profitable at all though. Trading is a much better alternative, because it is more advantageous. People aren’t trading though, because of a couple of misconceptions and unawareness. Read on to find out why you should start saving up money in a trading account.

In general people think that trading is intricate and they do not have the courage to take part of this world, because they do not know anything about it. Most people stick to the traditional savings method: saving money in a bank account and earning bank interest. Without regard that it could take over a 100 years for a savings account to double up by using this method.

According to the survey results of research agency MeMo, 55% of everyone thinks that trading is only for people that have profound knowledge of it. 11% are thinking of doing it, because they think that trading is more beneficial than saving money in the bank. However, these doubters and the others that have never traded before are too insecure to trade. They don’t trade because they are unaware that trading can be done in an easy way and that you can do it without much knowledge about it. Also, it is one of the best alternatives to a savings account.

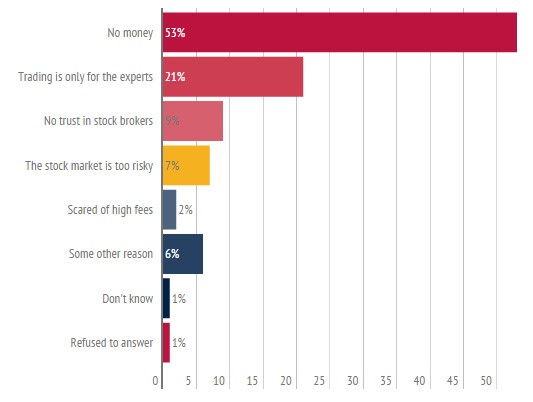

What are the main reasons people are not trading?

Source: Bankrate Money Pulse survey, March 19-22, 2015

However, most reasons stated are misconceptions:

-

You need a lot of money.

This isn’t the case, you can already start with only 25 euro. Even if it’s just for practice, it can be beneficial in the short and long-term. It is also about priorities, if you can save up a few euros a month why not buy a stock too that can benefit you later?

-

You need a profound knowledge of trading.

You don’t need to be a professional to trade. Jaff Chuck from Marketwatch.com says:

“A lack of knowledge shouldn’t stop a consumer from investing any more than a lack of knowledge about cooking should stop someone from eating”.

-

No trust in stock brokers or advisers.

If you are starting small, you probably don’t even need an advisor. You can trade independently and decide what you want to do with your money. It is easy these days with online trading. As for trusting stock brokers, there are ways to be sure that a broker can be trusted. Find ones that are regulated by a financial institute, like the ones we reviewed.

-

The stock market is too risky.

Nowadays, saving up money could cost you more money than the money you trade with. As of last year, the bank savings account interest rates has already descended to an historical low point of 1 percent. This means doubling your savings could a long, long time. People who have to pay property tax don’t even make money out of their savings anymore, they only see it vanish to the government. Saving up money in a bank account just doesn’t generate much wealth. If the economy goes down again, the money you save up wouldn’t be able to keep up with the inflation.

-

Scared of high fees.

Most people are unaware that nowadays a lot of online brokers offer very low-cost stocks. For example: CFD’s stock brokers.

We want to try and help people that are new to trading, because it is more beneficial and also keeps you updated with what goes on around the world. We find the trading world one of the most interesting and exciting market ever, that is why we want to share our passion and we hope you’ll share yours too. Start by learning about how to open a trading account.

Ps: Read our article on how to make a profit with just 160 EURO

Got any questions or comments? Please feel free to comment below or in our forum.