Guided Tutorial: How to Buy and Sell Ethereum CFD on Plus 500

Learning how to buy and sell Ethereum on an established broker is a good skill to know. Cryptocurrency is a booming market with lots of opportunities for the experienced trader. With Plus 500, traders can get started and join in on the multiple benefits of this new economic market.

Ethereum as a Cryptocurrency

If you think that Ethereum is just a currency, you’re highly mistaken. The Ether is a revolutionary addition to the crypto market and serves as a worthy alternative than Bitcoin. Ethereum is unique because it’s currency creates a system where anything can be programmed.

For instance, you can use ethereum to make secure contracts. These contracts can be used to fund startups faster than traditional incubator programs and venture capitalists. Because of this, it’s likely that Ethereum will share the same level of success as bitcoin and you can benefit from this as an investor.

What’s the Difference Between Ethereum and Bitcoin?

When first-time investors try to place Ethereum in the same line as bitcoin, they tend to miss out its utility. While they are both digital coins, they have huge differences. Ethereum’s major advantage is that it can be used for all sorts of projects.

Bitcoin and Litecoin are viewed as currencies and can be traded online to receive products and services in a decentralized manner. However, you can do a myriad of things with Ethereum.

Did you know, that you can use Ethereum to create a political system or issue shares with the currency? With ethereum, it’s not mutable; This means that once the contract is made, the contents within it cannot be changed.

As a result, Ethereum is powerful against malicious hackers who attempt to steal data from the contracts. Ethereum’s increased security increases its long-term growth potential and shows signs of the price possibly increasing further. That’s why we’re going to teach you how to buy and sell ethereum so you can get in on the market while you still can.

How to Buy and Sell Ethereum CFD Using Plus 500

As an established CFD broker, Plus500 gives experienced traders the opportunity to buy and sell ethereum CFDs on their platform. We suggest that you start with a demo account, so you know how to trade effectively before using your own money. Here is a step by step guide on how to buy and sell CFD ethereum on Plus 500’s exchange:

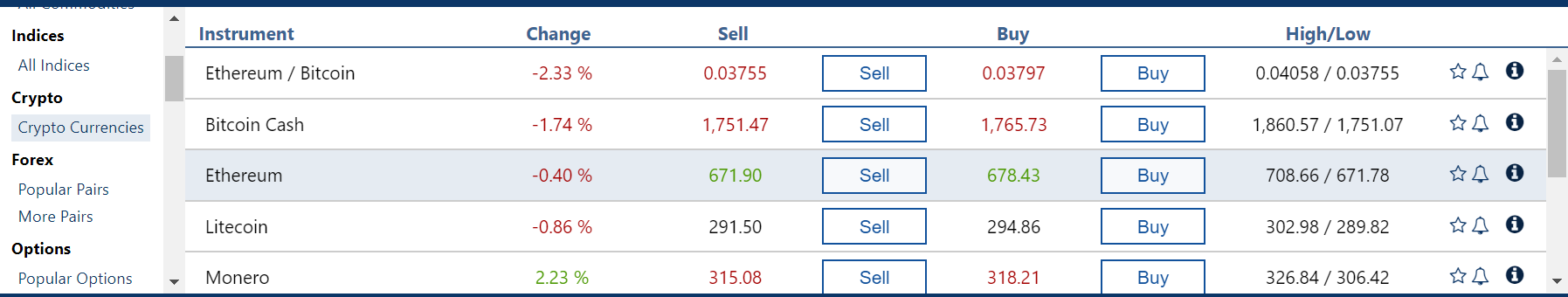

Start off by creating a demo or real account with Plus 500. Click Cryptocurrencies and scroll down to Ethereum (Alternatively: Click “Search our Instruments” on the top left of the screen and type Ethereum).

* Illustrative prices

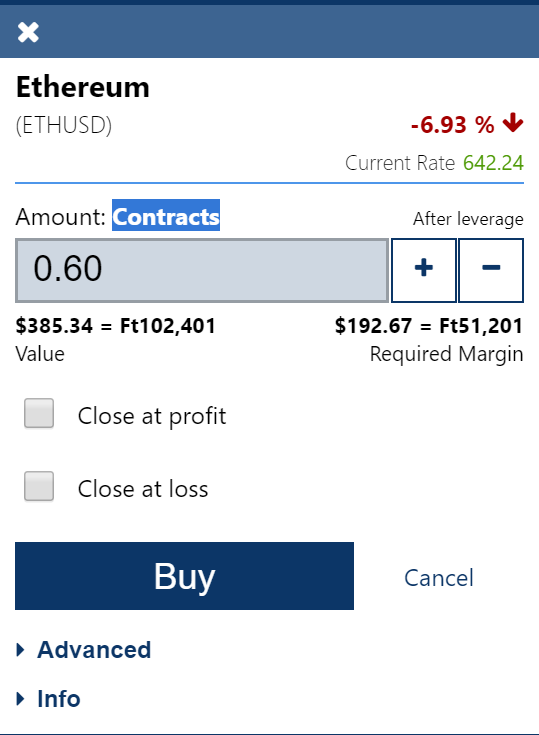

Set the price that you want to buy Ethereum at and press BUY.

* Illustrative prices

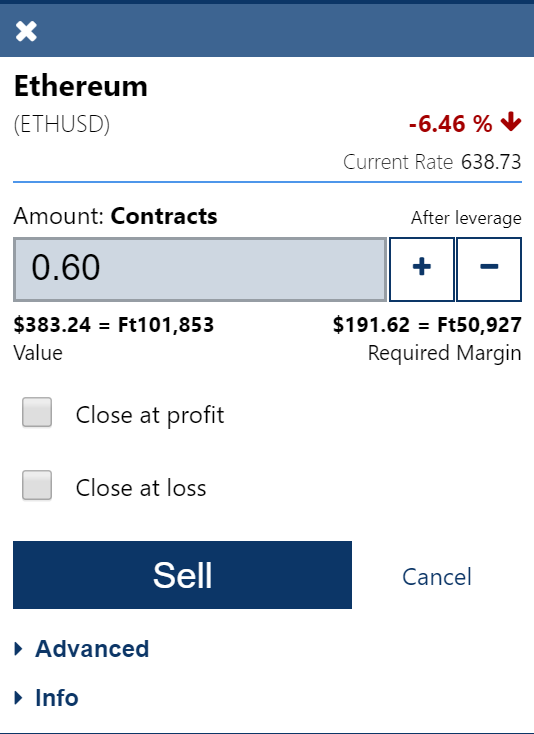

To sell ethereum, click the SELL button to close the position and sell your position.

* Illustrative prices

For a more detailed explanation on how to open and close a trade, please check this tutorial: Plus500

Other Tips

To buy and sell CFD ethereum more effectively, you have to set a stop-loss and a stop-limit. Stop losses will help by automatically selling the position if its value reaches below a certain value.

For example: Let’s say that Ethereum has a value of $600. Making a stop-loss of $400 ensures that you can sell the position once it reaches this value. Doing this allows you to minimize your losses so that you don’t lose too much money investing in ethereum.

With a stop-limit, you can make quick profits off of ethereum. Going off our previous example, Ethereum has an initial value of $600. When you set up a stop limit of $800, it will close the position once it reaches $800. This ensures that you receive a $200 profit once the position is closed.

Remember, always trade carefully when using Plus 500. While using a stop-loss and stop-limit will help reduce your risks, you have to make sure you research what you’re investing. This allows you to trade and manage your own risk.

Conclusions

To conclude, Plus 500 provides a user-friendly interface for investors to buy and sell CFD ethereum. It allows you to open and close positions at any time and trade without your information being compromised.

Start with Plus 500 today to break into the cryptocurrency market!

*72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.